By Justin Sayers July 8, 2025

The Texas Legislature heeded the call of business leaders to permanently extend and expand the state’s research-and-development tax credit, which is estimated to lead to the creation of 113,000 jobs and generate nearly $139 billion for the state’s gross domestic product over the next decade.

The program, which was launched in 2014, essentially provides those engaged in qualified research to claim either a sales tax exemption on personal property used in qualified research or a franchise tax credit based on qualified research expenses. It was set to expire at the end of 2026.

Legislators passed Senate Bill 2206 from State Sen. Paul Bettencourt, R-Houston, which is set to go into effect on Jan. 1. It is similar to the current law, and, in part, ups the Texas credit offered to 8.72%, or 10.9%, of new R&D in Texas.

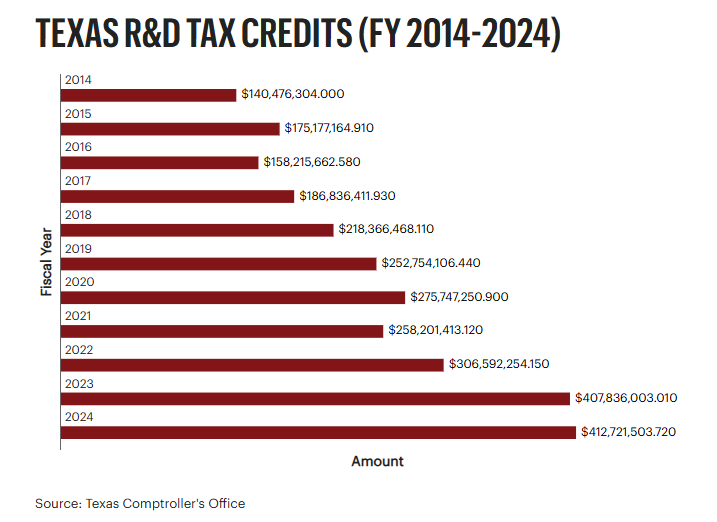

Over the course of the program, data from the Texas Comptroller’s Office shows that about $2.8 billion of these tax credits have been claimed, including a high of $412.7 million during fiscal 2024. Experts believe it will now lead to more.

“I think you’re going to see that those conducting R&D will continue to do that and may even move R&D that they’re doing in other states to Texas. Of course, we strongly believe that is a gateway to more advanced manufacturing investment,” said Tony Bennett, president and CEO of the Texas Association of Manufacturers and a founding member of Texans for Innovation, which pushed the bill.

Texans for Innovation also includes the Texas Association of Business, Texas Healthcare and Bioscience Institute, Texas Taxpayers and Research Association, Texas Chemistry Council, Texas Oil & Gas Association, Texas Economic Development Council, Dallas Regional Chamber of Commerce, Greater Houston Partnership, North Texas Commission, Opportunity Austin and Lockheed Martin.

The group commissioned an economic impact study, which found the credits are extremely common in other states — and the rest of the world — while companies are also eligible for tax credits through federal programs. For instance, China offers a “super deduction” of 200% for R&D, while California offers 15% on qualified research expenditures in the state, plus 24% of research payments to a public university, public university hospital or cancer research center.

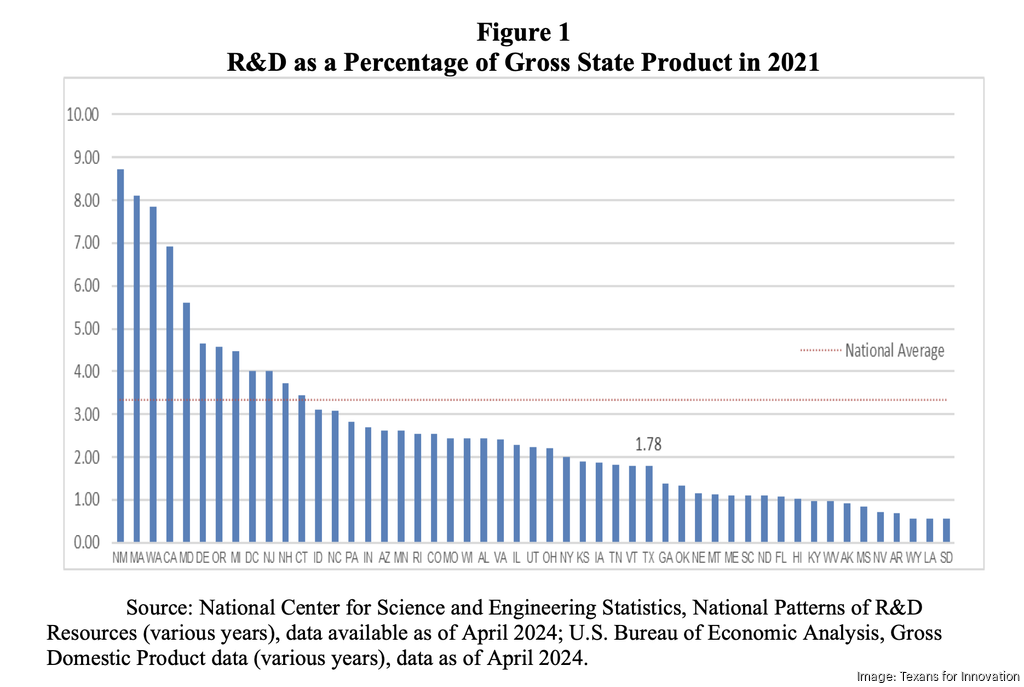

Texas ranked fifth in the country, as of 2022, in business-funded R&D expenditures, with 4.3% of the $608 billion funded by businesses in the U.S behind California (36.2%), Washington (9.2%), Massachusetts (7.1%) and New York (4.9%), according to the study. But Texas ranked 33rd in terms of R&D expenditures, with a ratio of 1.78 relative to the state economy as a percentage of gross state product, which was below the 50-state average of around 3.0.

The expansion will lead to the aforementioned job creation and GDP investment, along with $8.5 billion in wages, the study found. The cost of expanding the credits was estimated at $661.4 million in FY 2026. But that increase in estimated economic activity would also lead to higher state revenue from property and sales taxes, minimizing fiscal impacts, and could result in a net economic gain of $58.8 billion over 20 years.

Texans for Innovation

Opportunity Austin said it will ensure companies, particularly those in the growth stage and capital-intensive businesses, to scale innovation and remain competitive.

“Modernizing the program will allow businesses to reinvest in talent, equipment, and technology at a pivotal time for Texas’ economy,” the statement said. “The enhanced credit also fosters stronger collaboration between industry and higher education institutions — bolstering applied research, commercialization efforts, and innovation pipelines across critical sectors including semiconductors, biotechnology, and advanced manufacturing.”

Companies like EnergyX echoed that. The lithium extracting company that services the electric vehicle sector has a new mining process called lithium extraction that helped it raise more than $140 million, move its headquarters to Austin and work on a lithium processing facility in East Texas. But it hasn’t been eligible for the tax credit because it was in the pre-revenue phase.

Kelly Lugar, EnergyX’s executive vice president for government affairs, said her team will apply for credits as soon as possible. While the company can survive without it, state and federal incentives provide a notable new level of financial security. Plus, she argued it’s good for the state’s business friendly reputation, the energy industry as a whole, supply chain resilience and, in turn, national security.

“What the incentives do is they expedite timelines, they provide security, they make it easier to raise capital,” Lugar said. “It brings these projects online much more expeditiously, and that’s what this country needs, quite frankly. We are in a race to build a domestic battery supply chain, and EnergyX is at the forefront of that, so the R&D tax credit will certainly help expedite those initiatives.”

Nicholas Labinsky, CEO of Austin-based Premier Research Labs, expressed excitement about the higher education aspect. The dietary supplement manufacturer has been using the R&D tax credits over its 35 years in business to help offset that tax burden as it sells its own brands or works with health practitioners to sell theirs. Labinsky has been looking to partner with higher education institutions on clinical studies, and this would incentivize that.

“I think that’s just a very good move to get us to move forward because we wanted to do that but we’ve been cautious with the economy and everything that’s happening,” Labinsky said. “I think this is going to help enable us to do even more and push innovation more than we have in the past.”

Bennett at the manufacturing association said the credits are not the end-all be-all toward increasing manufacturing. There are barriers to bringing some manufacturers here or incentivizing expansion. Another bill would have tweaked the Texas Jobs, Energy, Technology & Innovation Act, the replacement to Chapter 313 that’s been rarely used due to wage requirements. That was a no-go.

“We had received reports from prospects that want to locate and invest in Texas that that hurdle is just extremely too high. We are very concerned that we could and we have already lost some projects because of that. That is something that needs to be rectified as soon as possible,” Bennett said.